Measurements of MIMO Indoor Channels at 1800 MHz with Multiple Indoor

Dec 1, 2007 · Both outdoor and indoor locations are considered for the transmitters or base stations, which allow the analysis of not only indoor but also outdoor-to-indoor environment.

Enhancing 5G indoor mobile coverage with SUDAS

Jun 5, 2024 · For indoor scenarios, a mm-wave backhaul link between indoor and outdoor base stations would suffer from extreme penetration losses. Apart from this, indoor coverage

Integrated Base Station-Signalwing Corporation

Integrated Base Station 简介 With the deployment of China''s 5G commercial network, 5G indoor coverage faces five technical challenges: full-spectrum access, flexible networking and multi

Study of the correlation between outdoor and indoor

Jan 1, 2019 · The main objective of this assessment is to study the correlation between the outdoor and the indoor exposure produced by cellular base stations and to investigate the

Huawei and China Mobile Shanghai Launch World''s First Indoor

Feb 15, 2021 · China Mobile is a pioneer of 5G construction in the world. The company has created more than 390,000 5G base stations since it got the commercial use license and has

Radio Base Stations Equipments toward Economical

Jan 13, 2011 · This article describes the development of the series of radio base stations equipments applicable to various implementa-tion areas, to economically expand the indoor

Modelling indoor electromagnetic fields (EMF) from mobile phone base

Radio frequency electromagnetic fields (RF-EMF) from mobile phone base stations can be reliably modelled for outdoor locations, using 3D radio wave propagation models that consider

ZTE Launches iMacro Base Station for Enhanced 4G LTE

Jul 15, 2015 · The new iMacro base station, with integrated RFUs (radio frequency unit) and antennas of compactness and high performance, was debuted at the Mobile World Congress

Ambitious 5G base station plan for 2025

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base

Measurements of MIMO Indoor Channels at 1800 MHz with Multiple Indoor

Both outdoor and indoor locations are considered for the transmitters or base stations, which allow the analysis of not only indoor but also outdoor-to-indoor environment.

Base station placement in indoor wireless systems using

Nov 1, 2006 · Request PDF | Base station placement in indoor wireless systems using binary integer programming | The placement of base stations is an important issue in planning

A 3D Indoor Positioning Method of Wireless Network with Single Base

Apr 14, 2022 · The proliferation of indoor location-based services has increased the demand of indoor positioning technology. Severe multipath and coherence effects are the difference

6 FAQs about [Division of indoor and outdoor base stations]

How much power does a base station use?

In the old network, one base station used three cabinets for GSM900, GSM1800, and UMTS2100 devices. Its overall power consumption was 4280 W. After the old base station was swapped with SDR, UMTS900 system was included and power consumption decreased by 57%.

Why is a base station important?

Environmental protection is a global concern, and for telecom operators and equipment vendors worldwide, developing green, energy-saving technologies for wireless communications is a priority. A base station is an important element of a wireless communications network and often the main focus of power saving in the whole network.

What is a soft base station?

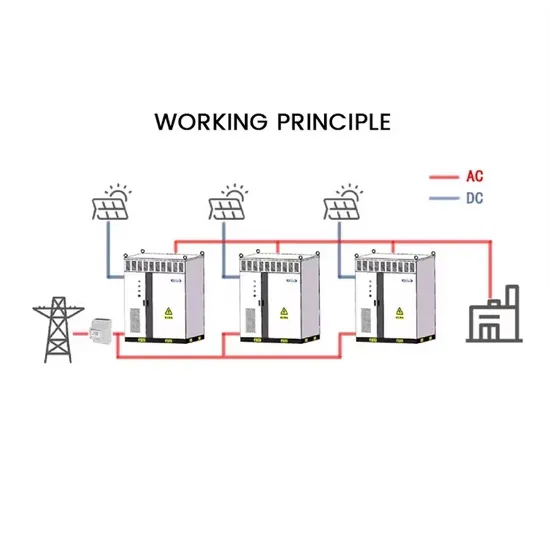

The modular design of an SDR soft base station allows innovation on the base station’s form. Two innovative forms are distributed base station and super baseband pool. In distributed base station, the Base Band Unit (BBU) is separated from the Remote Radio Unit (RRU), making network deployment more flexible.

How much power can a base station supply using wind?

2:8 to 5:5. But in any case, power supplied using wind cannot exceed 50% of the total power supply. The green base station solution involves base station system architecture, base station form, power saving technologies, and application of green technologies.

Why does a base station have low power utilization?

In a base station, the number of carriers is usually configured according to peak hour traffic. As a result, in idle hours, the power of some carriers is used in control channels rather than in traffic channels, leading to very low power utilization.

What should a base station do in a wireless communications network?

In a wireless communications network, the base station should maintain high-quality coverage. It should also have the potential for upgrade or evolution. As network traffic increases, power consumption increases proportionally to the number of base stations. However, reducing the number of base stations may degrade network quality.

Update Information

- Outdoor three-proof equipment cabinet for mobile base stations

- What is the power supply for outdoor communication base stations

- What are the outdoor power supply modules for base stations

- How much does wind power cost for outdoor communication base stations

- What are the outdoor wind power base stations in Singapore

- Outdoor photovoltaic considerations for base stations

- How to build a wind-solar hybrid outdoor power station for communication base stations

- What are the uses of wireless outdoor base stations

- What are the power supplies for telecommunication base stations

- Zagreb Outdoor BESS Outdoor Base Station Power Supply

- Supplier of wind and solar complementary components for Huawei s 5G communication base stations

- Tender for uninterrupted power supply to communication base stations

- What are Tunisia Communications 5G base stations

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.