Global Outdoor Power Equipment Market size is USD

Global Outdoor Power Equipment Market size is USD 32541.2 million in 2024. The Increasing construction projects requiring outdoor power equipment are expected to boost sales to USD

Outdoor Power Equipment Market Trends and Forecast

Global Outdoor Power Equipment Market Size Was Valued at USD 120.52 Million In 2023, And Is Projected to Reach USD 120.52 Million By 2032, Growing at A CAGR of 4.92% From 2024 To

How Many Outdoor Clothing And Equipment Shops are in Moscow

Jul 28, 2025 · There are 122 Outdoor clothing and equipment shops in Moscow Oblast, Russia. A random selection of cities, including Мытищи and Kotelniki, features a substantial number of

Outdoor & Country Life 2026 (Moscow)

Dacha Outdoor - a specialized exhibition of products for country house and outdoor leisure. Organized by MOKKA Expo Group with assistance of Mayer J. Group. Outdoor & Country Life

Russian Federation: Outdoor Equipment Market

Mar 9, 2025 · What is the size of the outdoor equipment market in the Russian Federation? How has the outdoor equipment market in the Russian Federation performed in value terms for the

List Of Outdoor clothing and equipment shops in Moscow

Download the list of Outdoor clothing and equipment shops in Moscow. Smartscrapers provides an accurate directory and the latest data on the number of Outdoor clothing and equipment

Russia abandons modernization of power plants due to lack

Feb 14, 2025 · The Russian government has allowed several companies to abandon the modernization of over a dozen power plants across the country, the Russian news agency

Update Information

- Function of outdoor base station wind power equipment box

- Camping equipment outdoor communication power supply BESS

- Outdoor power supply equipment or power supply

- Outdoor Power Camping Equipment

- Outdoor camping equipment lithium power storage

- North Asia s new outdoor power supply equipment

- How many watts are required for 1 kWh of outdoor power supply

- Outdoor power supply assembly box

- Uruguay Camping Outdoor Power Store

- Large-scale photovoltaic power station energy storage equipment

- DC discharge outdoor power supply

- How to shut down the outdoor power supply of the folding photovoltaic container

- How to build a wind-solar hybrid outdoor power station for communication base stations

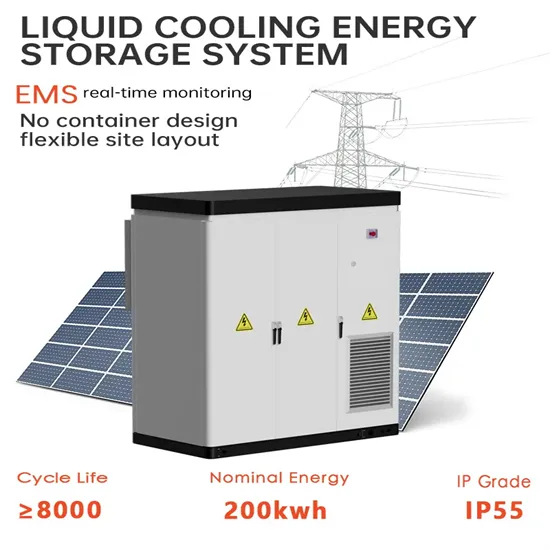

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.