Vietnam Base Station Signal Amplifier Market Size, Forecasts,

Jul 28, 2025 · The Vietnam Base Station Signal Amplifier Market is witnessing robust growth, primarily driven by the expanding mobile telecommunications infrastructure and the rapid

Vietnam: PDP 8 Revised

Apr 17, 2025 · Details of the power capacity targets of each power source in the Adjusted PDP8, compared to the PDP 8 is presented below. Installed Capacity by Power Source Through 2030

Vietnam''s Electricity market reforn

Jul 18, 2025 · VIETNAM POWER MARKET IN BRIEF – INSTALLED CAPACITY In 2022, there are 4 power plants that directly participate in the electricity market, with a total installed

Vietnam sets 5G infrastructure target at 50% of 4G base stations

Jul 14, 2025 · Vietnam targets 68,457 5G base stations by 2025, covering 90% of the population and enabling nationwide digital transformation.

Telecommunications – Management and Development of Mobile Base Stations

Jan 2, 2025 · In Vietnam, the construction and development of BTS stations have also encountered some difficulties since 2006. This report reviews the scientific basis, the

Mitsubishi Electric Achieves World''s First Performance

TOKYO, June 12, 2025 - Mitsubishi Electric Corporation (TOKYO: 6503) announced today announced today that it has developed a world''s first 1 compact 7GHz band gallium nitride

Mitsubishi Electric Achieves World''s First Performance

TOKYO, June 12, 2025 - Mitsubishi Electric Corporation (TOKYO: 6503) announced today that it has developed a world''s first 1 compact 7GHz band gallium nitride (GaN) power amplifier

P P. Địa chỉ: Tầng 8-11 tháp A, Tòa nhà EVN, 11 Cửa Bắc

Mar 17, 2020 · Địa chỉ: Tầng 8-11 tháp A, Tòa nhà EVN, 11 Cửa Bắc, P.Trúc Bạch, Q.Ba Đình, TP.Hà Nội. Điện thoại: 024.3927 6180 * Fax: 024.3927 6181.

mkaing EIRP Meausurements on 5G Base Stations

Jan 22, 2020 · New methods of measurement have had to be developed that can be performed on any configuration of base station, however complex. These must go beyond a simple

Vietnam''s 5G Base Stations are ready for India

The company has deployed this technology in several provinces across Vietnam, including Hanoi and Da Nang, and plans further expansion. Notably, Viettel High Tech is also exporting its 5G

Vietnam: PDP 8 Revised

Apr 17, 2025 · Vietnam: PDP 8 Revised – Vietnam''s 2030 Installed Power Capacity Targets On 15 April 2025, the Prime Minister of Vietnam issued Decision No. 768/QD-TTg, approving the

Mobile base station site as a virtual power plant for grid

Mar 1, 2025 · Furthermore, it seeks to determine if the full activation time can meet the requirements of an FFR product. The system consists of a live mobile base station site with a

Vietnam Revises PDP8: Targets of the National Power

Apr 17, 2025 · Vietnam''s government has approved the adjustment of the National Power Development Plan for the 2021-2030 period, with a vision to 2050 (PDP8). The revision sets

6 FAQs about [Vietnam Power Signal Base Station 125kWh]

How is the power transmission system simulated in Vietnam?

The methodology for the study is briefly shown in Figure 3-1. In this study, Vietnam's power transmission system (500-220kV) will be simulated in peak/off-peak load conditions with the largest proportion of renewable energy sources (lowest system inertia).

Which is the largest conventional generating unit in Vietnam?

According to PDP 8, by 2030, a generating unit of O Mon thermal power plant will be the largest conventional generating unit in Vietnam’s power system with the capacity of 1050 MW. The contingency in that unit is simulated at 5 s after the normal steady state operation.

How is the power transmission system in Vietnam based on PDP 8?

The simulation is performed by using data from Vietnam’s power transmission system (500 – 220 kV) in 2030 according to the PDP 8. The following operation modes are considered in the simulation: Day time peak load- The proportion of renewable energy proportion is about 21.4%.

What will Vietnam's power system look like in 2030?

By 2030, the proportion of renewable energy in Vietnam’s power system is expected to increase to about 30%, the total inertia of the system will be reduced to 1.777s. The simulation is performed by using data from Vietnam’s power transmission system (500 – 220 kV) in 2030 according to the PDP 8.

How much power does Vietnam have?

The growth of the installed capacity in the period of 2011 - 2022 is shown in Figure 1-4. In this period, the total installed capacity grew from 23 GW to over 80 GW with the average rate of 12% per year. Before 2019, Vietnam's power sources were mostly traditional plants, such as coal-fired, gas-fired, and hydropower plants.

What is the inertia of Vietnam's power system in 2022?

If all generating units in the system are considered, the total inertia of Vietnam’s power system in 2022 is about 1.785s. By 2030, the proportion of renewable energy in Vietnam’s power system is expected to increase to about 30%, the total inertia of the system will be reduced to 1.777s.

Update Information

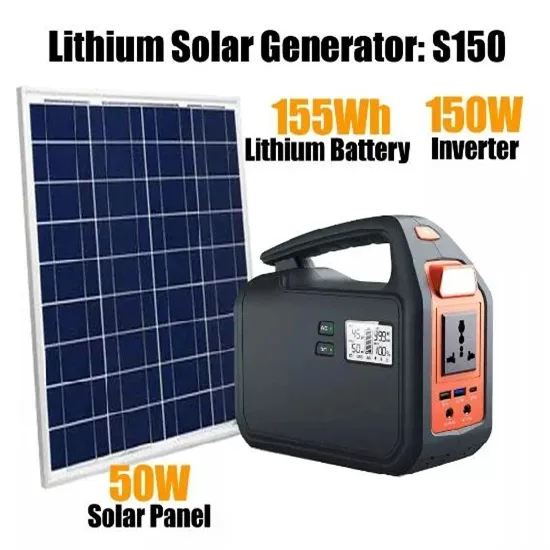

- Vietnam base station power supply equipment

- Communication base station inverter grid-connected signal tower power supply

- Signal tower base station 48v power supply

- Signal base station has backup power supply

- Communication base station wind power signal frequency

- Power signal base station in Lisbon

- Communication base station uninterruptible power supply signal tower splicing method

- Which is the best solar power company for communication base station roof

- Bahrain communication base station photovoltaic power generation system quotation

- Base station power supply arrangement

- Base station communication equipment power module

- Zagreb Outdoor BESS Outdoor Base Station Power Supply

- Cote d Ivoire Outdoor Base Station Power Cabinet Company

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.