Power system considerations for cell tower applications

Jul 7, 2011 · ting the generator set and power system configuration for the cell tower. At the same time, t ere are certain loads that every base transceiver station (BTS) will use. These loads are

research on lightning protection and grounding safety

May 29, 2022 · Building 5g base station on power tower is an effective way to realize resource integration and save national resources. However, the voltage level and installed capacity of

Cell Phone Tower Management and Base Station Safety

The recent analysis conducted by the manufacturer and network operator state that the energy required by the base stations should be 24*7 and this amount of energy requirement is very

Tower base station energy storage battery

Sodium ion batteries present a compelling solution to address the energy needs of telecom towers and 5G base stations, offering several advantages: Off-Grid Power Solutions: Many telecom

Cooling for Mobile Base Stations and Cell Towers

May 5, 2025 · Many base stations and cell phone towers are found in isolated locations that can be difficult to quickly access and repair. As a result, long life operation is required in wireless

CELL PHONE TOWER BASE STATION SAFETY AND

Jun 28, 2025 · This paper introduce the worthy approaches to protect the Tower Base station and continuous undisturbed operations of Tower base station. Safety Monitoring in the Base

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · A multi-base station cooperative system composed of 5G acer stations was considered as the research object, and the outer goal was to maximize the net profit over the

13 Best Power Towers For Home Gyms In 2025

Apr 1, 2024 · The Steelbody strength training power tower is ideal if you''re looking for a high-quality tower at a reasonable price. The 14 gauge steel means the

Machine learning for base transceiver stations power failure

Dec 1, 2024 · Base Transceiver Stations (BTSs), are foundational to mobile networks but are vulnerable to power failures, disrupting service delivery and causing user inconvenience. This

Hybrid Power Supply System for Telecommunication Base Station

Jul 26, 2018 · This research paper presents the results of the implementation of solar hybrid power supply system at telecommunication base tower to reduce the fuel consumptio

Optimum sizing and configuration of electrical system for

Jul 1, 2025 · Proposed a model for optimal sizing & resources dispatch for telecom base stations. The objective is to achieve 100% power availability while minimizing the cost. Results were

Power consumption modeling of different base station types

Mar 3, 2011 · Energy efficiency of any deployment is impacted by the power consumption of each individual network element and the dependency of transmit power and load. In this paper we

6 FAQs about [Power tower base station]

What is a tower base station project?

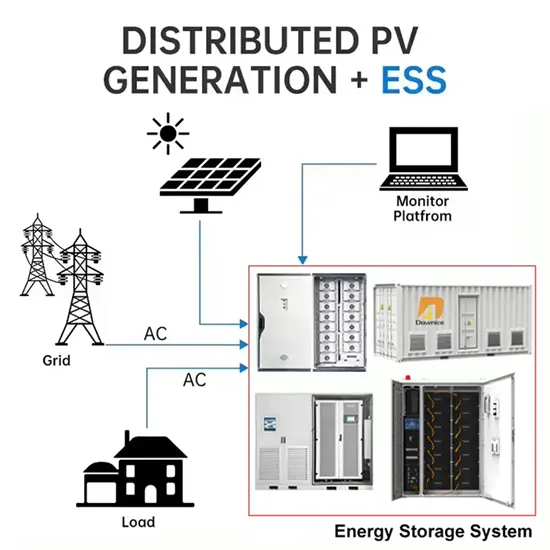

The tower base station project installs photovoltaic power stations on communication base stations, integrates into the national power grid, prioritizes power generation for communication base stations, collects electricity fees from China Tower Company, and simultaneously receives national and local photovoltaic power generation subsidies.

What is the iron tower base station project?

The iron tower base station project installs photovoltaic power stations on communication base stations, connects to the national power grid, gives priority to power supply for communication base stations, charges China Tower Company for electricity, and receives national and local photovoltaic power generation subsidies at the same time.

How much power does a cellular base station use?

This problem exists particularly among the mobile telephony towers in rural areas, that lack quality grid power supply. A cellular base station can use anywhere from 1 to 5 kW power per hour depending upon the number of transceivers attached to the base station, the age of cell towers, and energy needed for air conditioning.

How to design a solar-powered base station?

In order to design and implement a solar-powered base station, PVSYST simulation software has been used in various countries including India, Nigeria, Morocco, and Sweden. This software allows for estimation of the number of PV panels, batteries, inverters, and cost of production of energy considering the geographical and other design parameters.

What type of generator does a base station use?

The air conditioning of the base station runs at 220 VAC. These base stations can be powered by two types of diesel generators. The first is the conventional type where 220 VAC is converted to 48 VDC to charge the batteries and power the communication equipment.

Is there a direct relationship between base station traffic load and power consumption?

The real data in terms of the power consumption and traffic load have been obtained from continuous measurements performed on a fully operated base station site. Measurements show the existence of a direct relationship between base station traffic load and power consumption.

Update Information

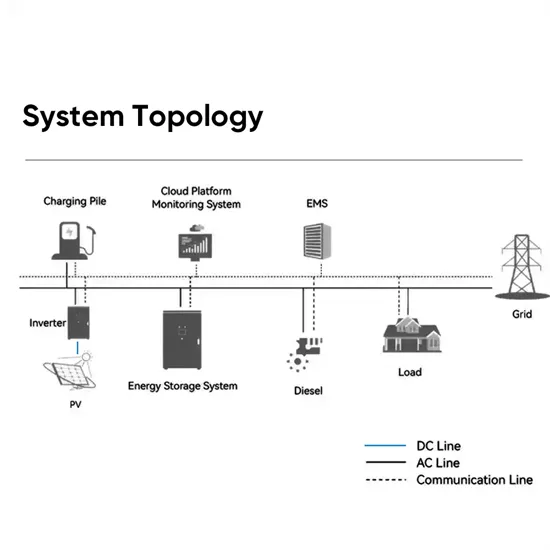

- Power tower and communication base station sharing

- Moscow base station and power tower

- Base station power tower

- Signal tower base station 48v power supply

- Communication base station inverter grid-connected signal tower power supply

- Grenada power signal tower base station

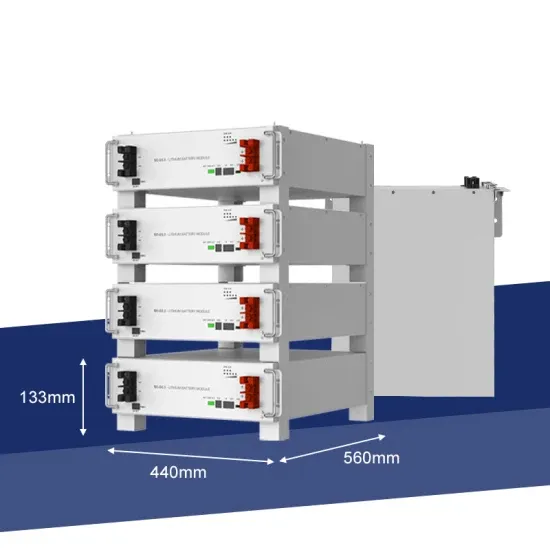

- Requirements for power system of base station with battery cabinet

- Vientiane Power Plant 5G Base Station

- 5g base station wind power photovoltaic energy storage

- Huawei s 5g base station power consumption lags behind

- Nassau Communication Base Station Wind Power Construction Company

- Portable communication base station power supply

- The communication base station wind power is just outside the window

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.