Super Capacitors Market By Application: North America | Asia

Jun 28, 2025 · Gain in-depth insights into Super Capacitors Market Report from Market Research Intellect, valued at USD 3.5 billion in 2024, and projected to grow to USD 9.

Asia Pacific Electric Capacitor Market Size & Share: 2022-2027

By Type, Asia-Pacific electric capacitor market is segmented into aluminium, ceramic, tantalum, Paper & Film, and super-capacitors. Cars, buses, trains, cranes, and elevators, among other

Asia-Pacific''s Capacitor Market to Exhibit +1.7

Jun 11, 2025 · In value terms, electrical capacitors; fixed, ceramic dielectric, multilayer ($14.9B) remains the largest type of electrical capacitors supplied in

Top 7 Supercapacitor & Ultracapacitors Manufacturers

Aug 16, 2024 · Explore the top 7 supercapacitor manufacturers that are leading the way in energy storage innovation. Discover industry leaders, cutting-edge technologies, and their global impact.

A-Pac Supercapacitors/Ultracapacitors Market Report I BIS

Apr 9, 2025 · The Asia-Pacific supercapacitors/ultracapacitors market is projected to reach $12,968.6 million by 2033 from $1,946.6 million in 2023, growing at a CAGR of 20.88% during

Recent advancement of supercapacitors: A current era of

Feb 1, 2025 · Electrostatic capacitors have higher power density than supercapacitors, but they can reach up to 10 kWkg−1. However, the specific energy of the supercapacitor is several

Super Capacitors Battery Energy Storage System

The global market for Super Capacitors Battery Energy Storage System was estimated to be worth US$ million in 2024 and is forecast to a readjusted size of US$ million by 2031 with a

Top Companies List of Supercapacitor Industry

These Electric Double Layer Capacitors (EDLCs) are designed for applications requiring high power density, rapid charge-discharge cycles, and long operational life, such as regenerative

Top Companies List of Supercapacitor Industry

Supercapacitor Market by Type (Electric Double Layer Capacitors, Hybrid Capacitors, Pseudocapacitors), Capacitance Range (<100 F, 100-1,000 F, >1,000 F), Electrode Material

Supercapacitors and Ultracapacitors

This report studies and analyses global Supercapacitors and Ultracapacitors status and future trends, helps the client to determine the Supercapacitors and Ultracapacitors market size of

Asia Pacific Super Capacitors Industry Report 2025 | Market

Sep 4, 2024 · The South East Asia super capacitors market is projected to witness growth at a CAGR of 17.2% in the forecast period, with a market size of USD 8.4 million in 2024. The Rest

Asia-Pacific Supercapacitor Market Analysis by Growth,

Asia-Pacific Supercapacitor Market by Product Type, Material, and End-user (Automotive, Industrial, Energy, and Aerospace & Defense), By Country, Competition, Forecast and

Top MLCC Manufacturers in the World

Apr 3, 2024 · The rise of AI further escalates demand for high-capacity MLCCs. Who are the industry leaders? Japanese giants like Murata and TDK lead, followed by South Korean and

Super Capacitors Market to Exceed USD 1388.12 million by

The Super Capacitors Market is segmented by product into dual-capacitor capacitors, pseudo capacitors, and hybrid capacitors.a trend anticipated to persist throughout the forecast period.

Top 10 Supercapacitor Manufacturers in the world

6 days ago · Now let''s profile the top supercapacitor manufacturers serving global markets. 1. Murata. Founded in 1944 and headquartered in Kyoto, Japan, Murata Manufacturing Co., Ltd

Asia-Pacific''s Capacitor Market to Grow at 0.9% CAGR,

Mar 19, 2025 · Learn about the rising demand for capacitors in Asia-Pacific, leading to an expected increase in market consumption over the next decade. By 2035, the market volume

6 FAQs about [Ranking of West Asia Super Capacitors]

What is the global supercapacitor market?

Supercapacitors, also known as ultracapacitors, are becoming a critical component in modern energy storage solutions. According to Stratistics MRC, the Global Supercapacitor Market is accounted for $5.08 billion in 2024 and is expected to reach $11.16 billion by 2030 growing at a CAGR of 14.0% during the forecast period.

Is Panasonic a supercapacitor?

Panasonic, a global electronics giant, has made significant inroads into the supercapacitor market. The company’s energy storage solutions are known for their reliability, long lifespan, and consistent performance across various applications. Key Products and Technologies:

Who are the major players in supercapacitor market?

Panasonic Corp. (Japan), Maxwell Technologies (South Korea), Eaton (Ireland), Nippon Chemi-Con Corp. (Japan), CAP-XX (Australia), Cornell-Dubilier (US), and Ioxus (US) among others are the key players in the supercapacitor market.

Who makes supercapacitor products?

Supercapacitor products are offered by the company under its Industrial Solutions segment. The company’s supercapacitor products are used in automotive, energy, and oil & gas applications. Maxwell Technologies

What are supercapacitors & ultracapacitor?

Supercapacitors or ultracapacitors offer unique advantages like ultrafast charging, reliable operation spanning millions of duty cycles alongside wide operating temperatures and collaborative integration with batteries or fuel cells for energy storage applications.

Which ultracapacitors are best for high power applications?

SkelCap Ultracapacitors: These are known for their unmatched energy density and long lifecycle, making them ideal for high-power applications. Curved Graphene Technology: This patented material significantly enhances the performance of their ultracapacitors, providing lower internal resistance and higher power output.

Update Information

- Photovoltaic curtain wall customization for West Asia office building

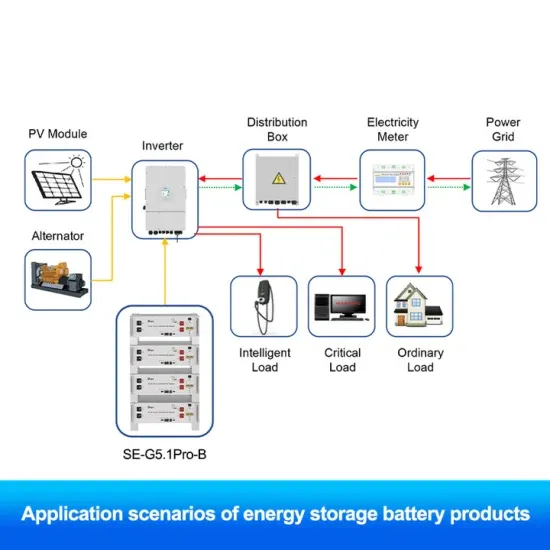

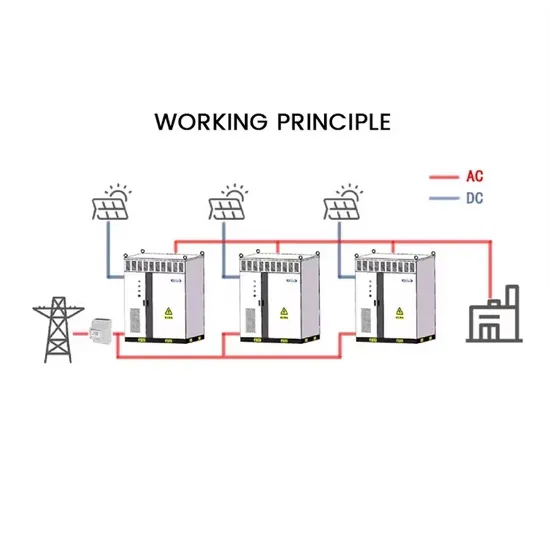

- West Asia Power Plant Energy Storage Project

- West Asia off-grid photovoltaic power generation system

- West Asia Portable Power Supply Manufacturer

- West Asia new container wholesale

- Production of super farad capacitors

- West Asia UPS Uninterruptible Power Supply 30kva

- Congo Communication Base Station Super Capacitor Lightning Protection

- Usage of Super Farad Capacitor

- Super graphene capacitor success

- Dominican Super Capacitor Manufacturer

- Communication Green Base Station Industry Ranking

- Telecom Super Large Energy Storage Cabinet

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.