Risk Communication Guide for Mobile Phones and Base

Sep 26, 2023 · RISK COMMUNICATION GUIDE FOR MOBILE PHONES AND BASE STATIONS People tend to place more weight on information that confirms their existing views. People

Communication Base Station Safety Standards | HuiJue

As 5G deployments accelerate globally, communication base station safety standards face unprecedented challenges. Did you know that 68% of urban base stations now operate

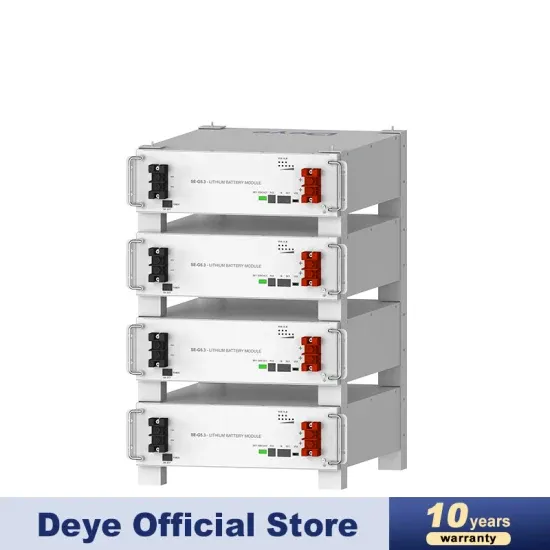

Energy storage system of communication base station

Energy storage system of communication base station Base station energy cabinet: floor-standing, used in communication base stations, smart cities, smart transportation, power

14.0 Beale AFB Communications System Design 2017

Nov 21, 2024 · All base areas have a communications system consisting of direct burial or underground manhole/duct system (MHDS)-based copper and fiber optic cables. Specific sites

Construction Procedures and Standards of Cellular

Feb 15, 2019 · 3.3 These Procedures and Standards provide details and set out the criteria to be adopted in relation to the construction of Cellular Mobile Base Stations and Towers including

NASA FACILITIES DESIGN STANDARD

Apr 29, 2021 · Codes: A collection of enforceable standards, rules, and regulations adopted by authorities having jurisdiction to control the design and construction, alteration, repair, quality

5G Mobile Communication Base Station Electromagnetic

Dec 15, 2023 · The current national policies and technical requirements related to electromagnetic radiation administration of mobile communication base stations in China are described,

What Is a Base Station PCB? A Complete Guide for 2025

Jun 14, 2025 · A base station PCB is a high-frequency printed circuit board used in wireless communication base stations. Unlike standard PCBs, these boards are designed to carry RF

Antenna Systems for Cellular Base Stations

Feb 19, 2023 · Base stations are used in many different communication standards and can be installed by public authorities, network providers, companies, or private persons. When talking

Energy-efficiency schemes for base stations in 5G

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

communications base stations: Topics by Science.gov

On Deployment of Multiple Base Stations for Energy-Efficient Communication in Wireless Sensor Networks DOE PAGES Lin, Yunyue; Wu, Qishi; Cai, Xiaoshan; 2010-01-01 Data

B18: Mobile Phone Base Stations

Dec 2, 2024 · Synopsis This guidance provides information for Managing Agents on the Electronic Communications Code and the management of risk where mobile base stations are located on

6 FAQs about [Design standards for communication base stations]

Is there a standard for a base station antenna?

The BSA’s influence on coverage, capacity, and QoS is extensive, and yet there exists no comprehensive, global, standard focusing on the base station antenna. The purpose of this whitepaper is to address this gap. In particular, the following topics will be covered in various degrees of detail:

What is the operating environment of a base station antenna?

The operating environment of base station antennas is classified as remote, stationary, outdoor, uncontrolled and not weather-protected. The electromagnetic environment includes close proximity to intentionally radiating devices and installation on structures prone to lightning strikes.

How many cables do you need to test a base station?

Up until this point, the methods used to specify, measure and regulate traditional base station transmission and reception had been fully conducted (i.e. taken at the antenna connector). This meant that activity of testing would in theory require up to 256 cables to be manually attached to the base station.

How does the new wave of wireless networks affect base stations?

Each new wave of wireless networks has increasingly challenged vendors to cost-effectively produce base stations with more sophisticated enabling technologies, more flexible support of multiple radio standards, and more capacity to meet increasing traffic demands.

How will a millimetre wave technology change base station architecture?

New antenna-integrated base station architectures were emerging and looking forward, an exciting breakthrough in the feasibility of using millimetre wave technologies was on the horizon. This move up the spectrum would ultimately change how we approach base station architecture.

What is a 4G base station?

The base station sits at the heart of the network platform. Traditional 4G LTE base stations contain one, two or possibly even four transmitters and usually operate on core band frequencies of up to 2.5 GHz, sometimes even 3.5 GHz and 5 GHz.

Update Information

- Research on wind-solar complementary design of communication base stations

- Photovoltaic design quotation for communication base stations

- The latest national standards for battery energy storage systems for communication base stations

- How much does hybrid energy cost for Somaliland communication base stations

- Spacing between civil buildings and communication base stations

- Where is the energy management system for 5g communication base stations in Southern Europe

- What are the types of lead-acid batteries used in communication base stations

- Installation requirements for battery energy storage systems at communication base stations

- Uninterruptible power supply for Spanish communication base stations

- What are the battery rooms of Asian communication base stations

- What are the manufacturers of solar photovoltaic panels for communication base stations

- Where is the energy management system for Paris communication base stations built

- How is the EMS maintenance industry for communication base stations

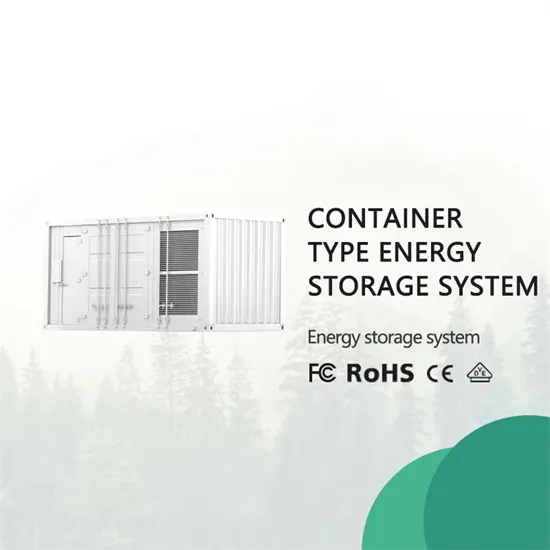

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.