Kuwait solar project: 1 GW Initiative for 2030 Renewable Goals

The 1 GW solar project will bring Kuwait closer to realizing this potential. Kuwait solar project to reduce costs and create jobs The 1 GW solar plant is expected to reduce Kuwait''s reliance on

Kuwait Aims To Award Solar Project By Year End | MEES

May 3, 2024 · Kuwait aims to award power purchase agreements (PPAs) for 1.1GW of new solar PV projects before the end of the year. Speaking to MEES on the sidelines of the World

MENA to add 50GW of utility-scale solar by 2030, report says

Jun 29, 2022 · With more than 30GW of projects announced as in development or in construction between Oman, Morocco and Kuwait, those jurisdictions will lead utility-scale solar PV in the

Solar energy in Kuwait: Benefits and challenges

6 days ago · For instance, the Shaqaya project, in collaboration with Kuwait Institute for Scientific Research (KISR), comprises of solar thermal, solar photovoltaic and wind power systems.

Kuwait Energy Storage Solar Solutions Powering Sustainable

As Kuwait accelerates its renewable energy transition, photovoltaic (PV) systems paired with advanced energy storage are reshaping the nation''s power infrastructure. This article explores

Electricity Ministry finalizes procedures for key renewable energy projects

May 6, 2025 · The Ministry of Electricity, Water and Renewable Energy is accelerating efforts to advance key electricity and water generation projects, signaling a major step forward in

Kuwait solar project: 1 GW Breakthrough for Renewable

The project not only supports Kuwait''s environmental objectives but also bolsters its economic diversification efforts. Impact of the Kuwait solar project on the energy sector The 1 GW solar

Kuwait Launches Tender For 1,100 MW Solar Power Plant,

Jan 3, 2024 · Kuwait Authority for Partnership Projects initiates a tender for the Al Dibdibah Power and Al Shagaya Renewable Energy – Phase III – Zone 1 Solar PV project, aiming for a 1,100

Kuwait Plans New Solar Plants to Help Meet Power Demand

May 2, 2025 · Ministry of Electricity, Water and Renewable Energy, Kuwait is reviewing a plan to build four solar power plants. These projects would have a combined capacity of 2,000

Bids called for 1,100MW Kuwait solar PV project

Feb 1, 2024 · The Kuwait Authority for Partnership Projects (KAPP) has invited bids from leading global and regional construction companies for the development of the third phase of Al

Kuwait, RFP for 1.1 GW project at Shagaya renewable energy

Jun 15, 2025 · These prequalified bidders will compete for the opportunity to develop the ambitious 1.1 GW solar photovoltaic (PV) project at Shagaya Renewable Energy Park. The

Kuwait launches tender for 1.1 GW solar power project

Aug 18, 2025 · The Kuwait Authority for Partnership Projects has launched the tender for the 1.1 GW Al Dibdibah and Al Shagaya Phase III Zone 1 solar project, targeting pre-qualified

Kuwait issues RFP for 1.1GW solar power project

Jun 15, 2025 · Kuwait Authority for Partnership Projects (KAPP) and the Ministry of Electricity, Water, and Renewable Energy has issued Request for Proposal

Largest Solar Power Stations in Kuwait | Photovoltaic Parks in Kuwait

Here is a list of the largest Kuwait PV stations and solar farms. Get to know the projects'' power generation capacities in MWp or MWAC, annual power output in GWh, state of location and

6 FAQs about [Kuwait Photovoltaic Glass Project]

Can a 1.1 GW solar project be built in Kuwait?

The Kuwait Authority for Partnership Projects and Kuwait ’s Ministry of Electricity, Water and Renewable Energy has issued a request for proposals from six prequalified bidders for a 1.1 GW solar project.

Where are Kuwait's solar power plants located?

The plants will also be located in the Shagaya Renewable Energy Park, which consists of wind, solar, concentrated solar power (CSP) and battery storage projects. Kuwait had approximately 50 MW of installed PV capacity and 50 MW of CSP capacity by the end of 2024, according to figures from the International Renewable Energy Agency (IRENA).

How much solar power does Kuwait have in 2024?

Kuwait had approximately 50 MW of installed PV capacity and 50 MW of CSP capacity by the end of 2024, according to figures from the International Renewable Energy Agency (IRENA). This content is protected by copyright and may not be reused.

What is a solar PV project?

The project scope covers development, financing, design, engineering, procurement, construction, testing, and commissioning of the solar PV plant, along with the construction of a 400 kV power transmission substation. Following a prequalification process conducted in August 2024, six bidders have been shortlisted.

How many solar plants will Kapp have in Shagaya?

Last month, KAPP launched a tender for two solar plants with a combined capacity of 500 MW. The plants will also be located in the Shagaya Renewable Energy Park, which consists of wind, solar, concentrated solar power (CSP) and battery storage projects.

Who are Saudi Arabia's energy consortia?

The four consortia include a coalition between Saudi Arabia’s ACWA Power and Kuwait’s Alternative Energy Projects Company, alongside another consisting of France’s EDF Renewables, Kuwait’s Abdullah Al Hamad Al Sagar and South Korea’s Korean Western Power.

Update Information

- Photovoltaic glass project construction

- Photovoltaic curtain wall glass building project

- Congo Photovoltaic Glass Project

- Dominican Photovoltaic Glass Project

- Tiraspol Photovoltaic Glass Project

- Kuwait New Energy Photovoltaic Power Generation Glass Crystalline Silicon

- Maseru Photovoltaic Glass

- Middle East 300W photovoltaic glass price

- Nanya Photovoltaic Centralized Energy Storage Project

- Architectural Photovoltaic Laminated Glass

- Nicaragua s largest photovoltaic glass factory

- What can a photovoltaic glass factory do

- Africa double glass photovoltaic curtain wall price

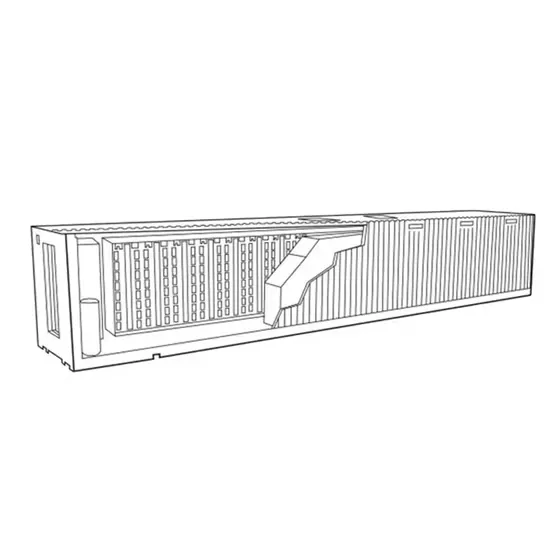

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.