Battery energy storage system for grid-connected

Nov 15, 2023 · Battery energy storage systems (BESS) are considered as a basic solution to the negative impact of renewable energy sources (RES) on power systems, which is related to the

Profitability, risk, and financial modeling of energy storage in

Jan 15, 2017 · The incorporation of energy storage systems in the grid help reduce this instability by shifting power produced during low energy consumption to peak demand hours and hence

German batteries stabilizing solar energy prices at expense

Jul 1, 2025 · German batteries stabilizing solar energy prices at expense of own profitability Analyst THEMA Consulting Group has calculated the impact of rapid expansion of battery

Energy storage project profitability analysis

1.3 Need for Economic Analysis. Although a battery storage plant provides great benefits to the grid in terms of peak shaving, storage of excess energy, promote development of renewable

Economics of Grid-Scale Energy Storage in Wholesale

Sep 22, 2021 · My equilibrium framework adds key modeling features to the literature by allowing (1) storage''s price impact and (2) incumbents to best response to energy storage''s production.

Optimizing battery science for maximum efficiency and profitability

Battery storage is revolutionizing the energy sector, playing a pivotal role in grid stability, renewable energy integration, and cost efficiency. But understanding the science behind

Energy Storage Company Profitability: How Battery Giants

Jun 1, 2019 · Why Energy Storage Is the New Gold Rush Let''s face it: energy storage companies are having a "Tesla Moment." With global battery installations projected to hit 1,200 GWh by

Energy storage for mitigating grid congestion caused by

Feb 1, 2023 · Energy storage for mitigating grid congestion caused by electric vehicles: A techno-economic analysis using a computationally efficient graph-based methodology

Energy Storage Profitability Schemes: How Batteries Are

Jun 24, 2025 · From playing electricity price arbitrage games to becoming virtual power plant rockstars, let''s unpack the secret sauce behind today''s most profitable energy storage models.

A comprehensive review of the impacts of energy storage on

Jun 30, 2024 · To address these challenges, energy storage has emerged as a key solution that can provide flexibility and balance to the power system, allowing for higher penetration of

Business Models and Profitability of Energy

Sep 11, 2020 · Battery energy storage systems (BESSs) are advocated as crucial elements for ensuring grid stability in times of increasing infeed of intermittent

Is Grid Energy Storage Profitable? Exploring the Economics

Feb 7, 2025 · With companies like China Southern Power Grid Energy Storage reporting 11.14% net profit growth in 2024 [1] [6], it''s become serious business. But how exactly does storing

Techno-economic profitability of grid-scale battery storage

Apr 1, 2025 · This study evaluates the techno-economic benefits of grid-scale battery storage allocation across 25 European countries, each with distinct wholesale

Economic Analysis of Typical Business Model of Grid-side Energy Storage

Nov 29, 2024 · Grid-side energy storage is an indispensable part of the future power system, and its market scale development is at a critical stage. To accelerate the development of the

Techno Economic Analysis of Grid Connected Photovoltaic

Jan 6, 2025 · The usage of solar photovoltaic (PV) systems for power generation has significantly increased due to the global demand for sustainable and clean energy sources. When

Policy options for enhancing economic profitability of residential

May 15, 2021 · We propose three types of policies to incentivise residential electricity consumers to pair solar PV with battery energy storage, namely, a PV self-consumption feed-in tariff

The Future of Grid-Scale Energy Storage: Driving Clean and

Feb 18, 2025 · Grid-scale energy storage is essential for enabling clean and resilient energy systems. As renewable energy sources such as wind and solar continue to expand, the need

Determining the profitability of energy storage over its life

Feb 1, 2025 · Levelized cost of storage (LCOS) can be a simple, intuitive, and useful metric for determining whether a new energy storage plant would be profitable over its life cycle and to

What does energy storage currently rely on for profitability?

Jan 9, 2024 · Energy storage profitability currently depends on several factors: 1. Technological advancements influencing efficiency and cost; 2. Market demand for renewable energy

Profitability analysis and sizing-arbitrage

Feb 14, 2024 · Profitability analysis and sizing-arbitrage optimisation of retrofitting coal-fired power plants for grid-side energy storage February 2024 Journal of

How much profit does energy storage power generation have?

Jul 18, 2024 · 1. Profits from energy storage power generation can be substantial, ranging from 15% to 50% internal rate of return (IRR), 2. Factors influencing profitability include

AEAUTO Grid-side Energy Storage Profitability And Application

Dec 5, 2024 · Low-carbon policies fuel grid-side energy storage''s rapid growth. This article details its advantages, apps, profit models & AEAUTO''s solution, highlighting its key role in power

The new economics of energy storage | McKinsey

Aug 18, 2016 · Importantly, the profitability of serving prospective energy-storage customers even within the same geography and paying a similar tariff can vary

6 FAQs about [Energy storage grid profitability]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Does a grid-level battery energy storage system perform energy arbitrage?

The present work proposes a long-term techno-economic profitability analysis considering the net profit stream of a grid-level battery energy storage system (BESS) performing energy arbitrage as a grid service.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How does energy storage affect the stability of an electric grid?

Without adequate energy storage, maintaining the stability of an electric grid requires equating electricity supply and demand at every moment. System Operators (SO) that operate deregulated electricity markets call up natural gas or oil-fired generators to balance the grid in case of short-run changes on either side.

Why is grid-scale energy storage important?

The characteristics of renewable energy from wind and solar power pose particular challenges to the operation and stability of the electricity grid. Grid-scale energy storage holds the promise of mediating the operational challenges created by their inherent variability, intermittency and non-dispatchability.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Update Information

- Manila Grid Energy Storage

- Grid energy storage capacity

- Photovoltaic surplus power into the grid energy storage

- Smart Grid Energy Storage Construction

- Large Energy Storage Power Station of Iran s Power Grid

- Bhutan Power Grid Energy Storage System

- Guatemala energy storage power station connected to the grid

- Grid Energy Storage 2025

- China Southern Power Grid Power Generation and Energy Storage Station

- Brunei Grid Energy Storage

- Home energy storage equipment connected to the grid

- China Southern Power Grid Lithium Battery Energy Storage

- Huawei Photovoltaic Grid Energy Storage New Energy

Solar Storage Container Market Growth

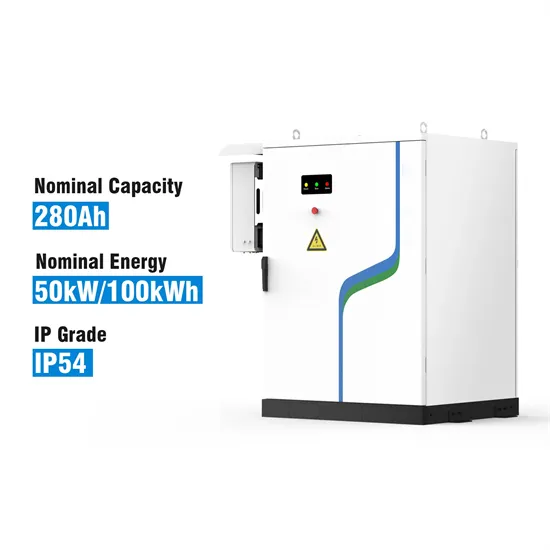

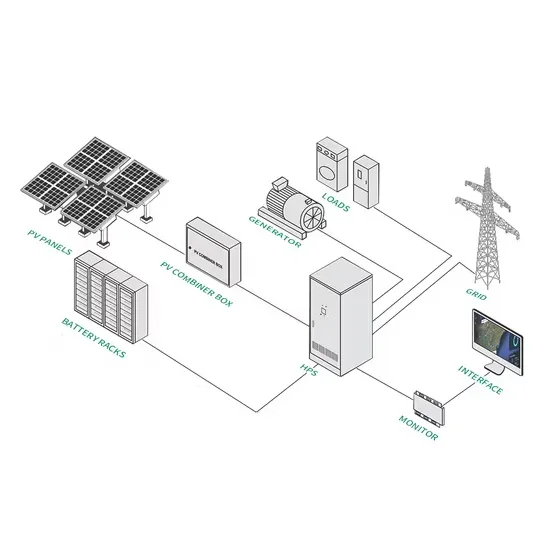

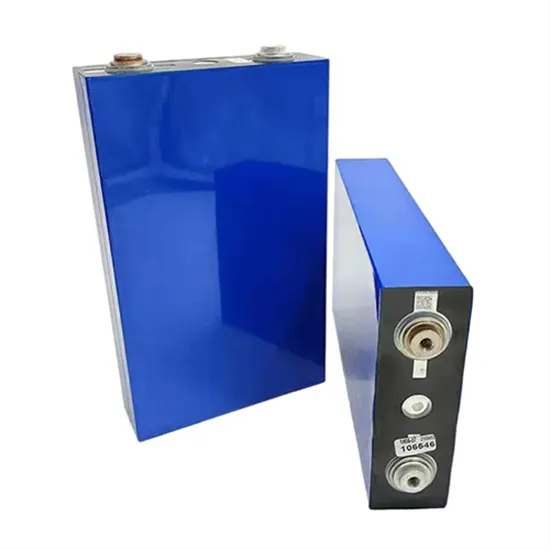

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.